ri tax rate income

Rhode Island state income tax rate. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that.

There are three tax brackets and they are the same for all taxpayers regardless of filing status.

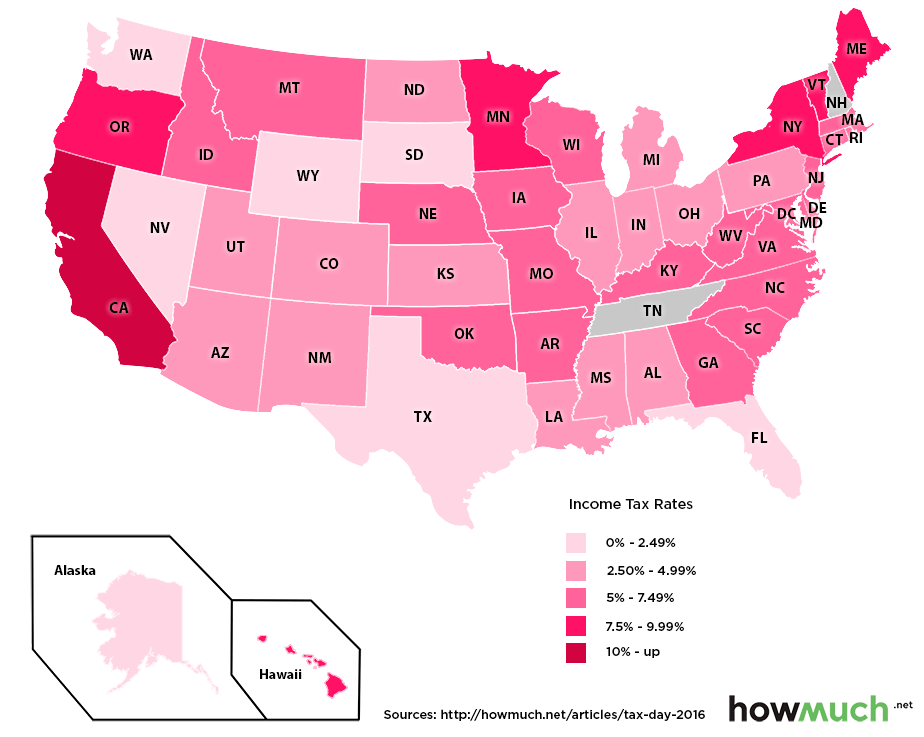

. Only the following credits are allowed against Rhode Island personal income tax. For income taxes in all fifty states see the income tax by state. Rhode Island state sales tax rate.

INCOME TAX AND CREDITS Using a paper clip please attach Forms W-2 and 1099 here. 2022 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Tax Bracket gross taxable income Tax Rate 0.

Terms used in the Rhode Island personal income tax laws have the same meaning as when used in a comparable context in the federal income tax laws unless a different meaning is clearly. The current tax forms and tables should be consulted for the current rate. 1 RI Earned Income Credit - RIGL 44-30-26c2N 2 Property Tax Relief Credit - RIGL 44-33 3 RI Residential Lead Abatement Credit - RIGL 44-303 4 Credit for Taxes Paid to Other States - RIGL 44-30-18 5 Historic Structures Tax Credit - RIGL 44-332.

To receive free tax news updates send an e-mail with SUBSCRIBE in subject line. 65250 148350 CAUTION. Your 2021 Tax Bracket to See Whats Been Adjusted.

The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. Below we have highlighted a number of tax rates ranks and measures detailing Rhode Islands income tax business tax sales tax and property tax systems. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Discover Helpful Information and Resources on Taxes From AARP. Head of household 13550. One Capitol Hill Providence RI 02908.

For an in-depth comparison try using our federal and state income tax calculator. Rhode Island taxes most retirement income at rates ranging from 375 to 599. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

For more information about the income tax in these states visit the Massachusetts and Rhode Island income tax pages. Pay 248250 648913 on Excess 375 475 599 of the amount over 0 66200 150550 RHODE ISLAND TAX COMPUTATION WORKSHEET Use for all filing status types TAX a b c d Subtract d from c Enter the amount from Multiplication Multiply a by b Subtraction Enter here and on RI-1040NR line 7 is. 2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over 244688 639413 375 475 599 on excess 0 65250 148350. Guide to tax break on pension401kannuity income. Any income over 150550 would be taxes at the highest rate of 599.

The state income tax rate in Rhode Island is progressive and ranges from 375 to 599. The Rhode Island tax is based on federal adjusted gross income subject to modification. Taxable income between 66200 and 150550 is taxed at 475 and taxable income higher than that amount is.

How does Rhode Island rank. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. The first 66200 of Rhode Island taxable income is taxed at 375.

The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of twenty four states with higher marginal corporate income tax rates then Rhode Island. It is one of the few states to tax Social Security retirement benefits though. Click the tabs below to explore.

Ad Compare Your 2022 Tax Bracket vs. 4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax. Rhode Island Standard Deduction Single 9050 Married filing jointly or Qualifying widower 18100 Married filing separately 9050 RI income tax from Rhode Island Tax Table or Tax Computation Worksheet.

Directions Google Maps. The first step towards understanding Rhode Islands tax code is knowing the basics. Subscribe for tax news.

3 rows Rhode Island state income tax rate table for the 2020 - 2021 filing season has three. Rhode Island state property tax rate. Rhode Island Division of Taxation.

Rhode Islands 2022 income tax ranges from 375 to 599. RI-1040 line 7 or Amount amount RI-1040 line 8 or Over RI. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

Rhode Island has a flat corporate income tax rate of 7000 of gross income. The income tax is progressive tax with rates ranging from 375 up to 599. This page has the latest Rhode.

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Where S My Rhode Island State Tax Refund Taxact Blog

Which U S States Have The Lowest Income Taxes

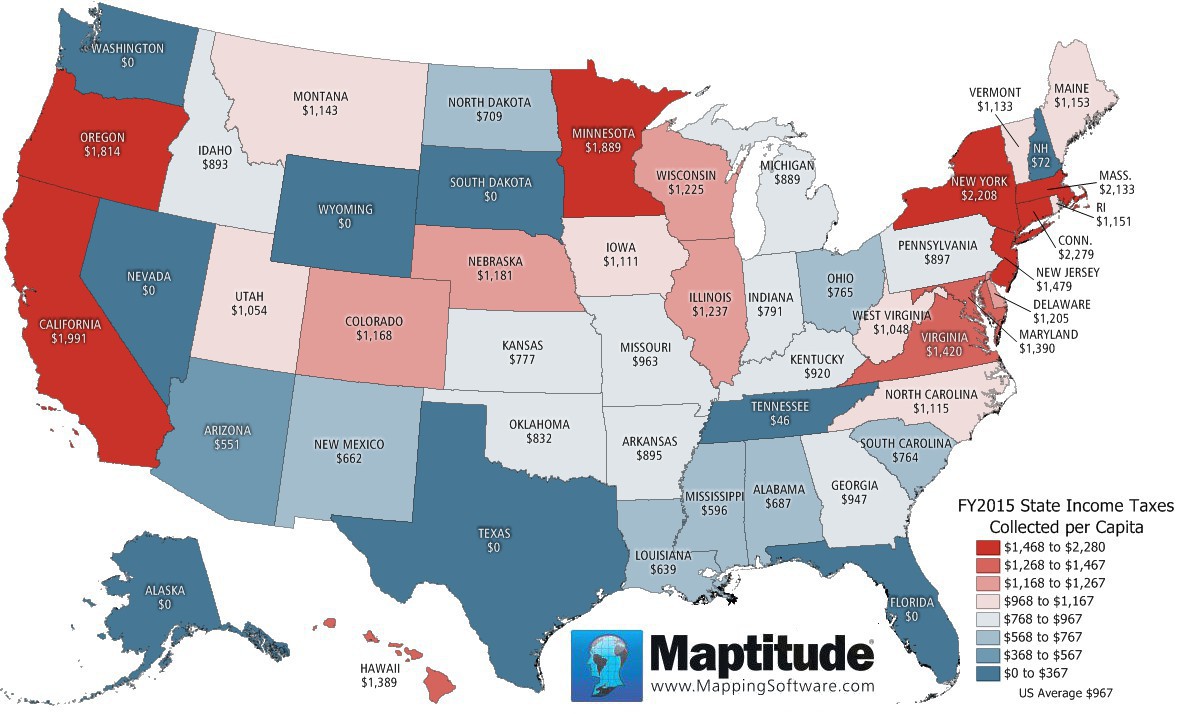

Maptitude Map Per Capita State Income Taxes

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Rhode Island Sales Tax Small Business Guide Truic

Rhode Island Paycheck Calculator Smartasset

Rhode Island Income Tax Brackets 2020

How Do State And Local Sales Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Who Pays 5th Edition The Institute On Taxation And Economic Policy Itep Income Tax State Tax Low Taxes

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)